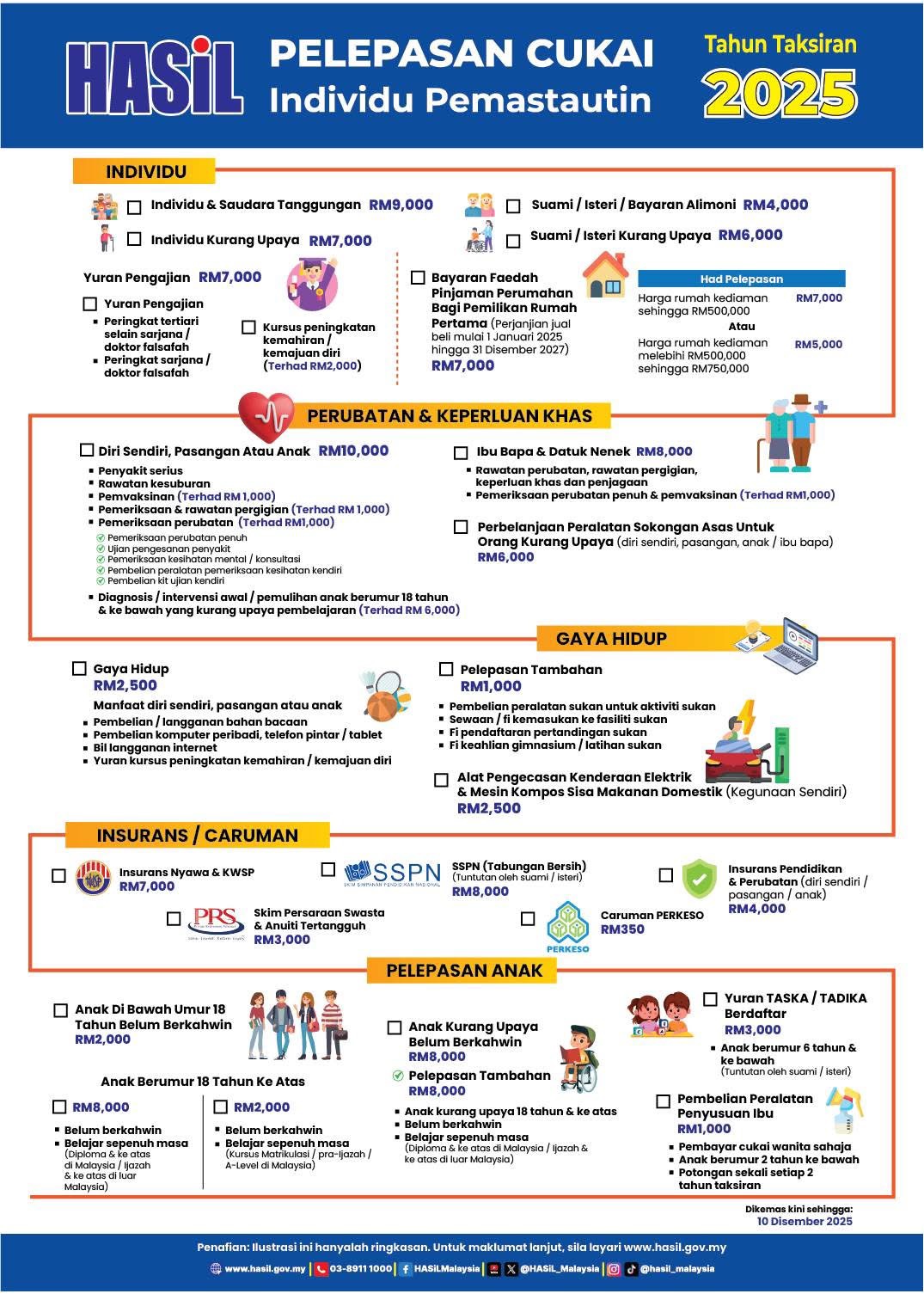

Malaysia 2025 – Individual Income Tax Relief

🧍♂️ 1. Individual / Spouse / Dependants

Individual & Dependants

• ✔ RM9,000

Individuals with disabilities

• ✔ RM7,000 (additional to basic personal relief)

Spouse / Former Wife / Alimony

• ✔ RM4,000

• Must be legally married OR court-ordered alimony

Disabled spouse

• ✔ RM6,000

⸻

🎓 2. Education Fees (Self) – Total limit RM7,000

Education Fees (Non-Master/PhD)

• ✔ Diploma, Degree, Professional courses

• ✔ Local or overseas

• ✔ Covers course fees, registration fees

Master / PhD level

• ✔ Coursework or research

• ✔ Local or overseas

Skill Upgrading Courses

• ✔ Maximum RM2,000

• ✔ Must be approved courses by government-recognised institutions

⸻

🏠 3. Housing Loan Interest (First Residential Property)

Eligibility

• Property must be your first residential home

• Loan must be for purchase of that home

• Property purchased between 1 Jan 2022 – 31 Dec 2027

Relief amounts

• ✔ RM7,000 (property ≤ RM500,000)

• ✔ RM5,000 (property RM500,000 – RM750,000)

⸻

🏥 4. Medical & Special Needs Reliefs

(A) Self / Spouse / Children – RM10,000

Includes:

• ✔ Treatment for serious diseases (cancer, heart disease, kidney failure, etc.)

• ✔ Ordinary medical treatments

• ✔ Vaccinations (up to RM1,000)

• ✔ Dental examination & treatment (up to RM1,000, excludes cosmetic dentistry)

• ✔ Medical checkup (up to RM1,000)

• Comprehensive health screening

• Disease screening tests

• Consultation fees

• Mental health services

• Self-test kits (Covid, HIV, thyroid, glucose, etc.)

Fertility treatment

• ✔ Up to RM5,000

• ✔ Includes IVF, IUI, ICSI

• ✔ Covers treatments for self/spouse or for a disabled learning child (≤18 years)

⸻

(B) Parents / Grandparents – RM8,000

Includes:

• Medical treatment

• Dental treatment

• Rehabilitation

• Nursing care

• Medication

• Comprehensive checkup + vaccinations (up to RM1,000)

⸻

(C) Disabled support equipment – RM6,000

Applicable to:

• Self

• Spouse

• Children

• Parents

Covers:

• Wheelchairs

• Prosthetics

• Hearing aids

• Orthopaedic supports

• Equipment for autism/learning disabilities

⸻

🏃♂️ 5. Lifestyle Reliefs

(A) Lifestyle (General): RM2,500

Covers:

• Books, e-books, magazines, newspapers

• Personal computer, laptop, tablet, smartphone

• Internet subscription

• Sporting equipment (non-motorised)

• Skill upgrading courses

• Subscription services (if officially recognised by LHDN)

⸻

(B) Additional Lifestyle – Sports: RM1,000

Covers:

• Sports activity fees

• Rental / entry fees for sports facilities

• Registration fees for sports competitions

• Gym membership fees

• Fees for sports classes (yoga, boxing, swimming, etc.)

⸻

(C) EV & Green Home Equipment: RM2,500

• Home EV charging equipment (personal use only)

• Home food waste processor

⸻

🛡️ 6. Insurance / Retirement / Savings

Life insurance + EPF (KWSP): RM7,000

• Automatically divided between EPF contribution and life insurance premiums

PRS + Deferred Annuity: RM3,000

SSPN Net Savings: RM8,000 (combined for husband & wife)

PERKESO contributions: RM350

Education & Medical Insurance (Self / Spouse / Children): RM4,000

⸻

👶 7. Child Reliefs

(A) Unmarried child (below 18)

• ✔ RM2,000

⸻

(B) Children 18+ (Unmarried & Full-time Students)

RM8,000

• Studying overseas: Diploma and above

• Studying locally/overseas: Bachelor’s degree and above

RM2,000

• Studying full-time in Malaysia

• A-Level / STPM / Diploma and above

⸻

(C) Disabled children

• Basic relief: RM6,000

• Additional relief: RM8,000

• 18 years and above

• Unmarried

• Full-time education (Diploma+ in Malaysia / Degree+ overseas)

⸻

(D) Childcare centre / Kindergarten fees

• ✔ RM3,000

• Child aged 6 and below

• Registered childcare centre / kindergarten

• Shared by husband & wife

⸻

(E) Breastfeeding equipment

• ✔ RM1,000

• For female taxpayers only

• For infants aged 2 years and below

• Claimable once every two YA

⸻

🗓️ Information valid as of: 10 December 2025